ny paid family leave tax category

Now after further review the New York Department of. Web New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

. New York paid family leave benefits are taxable contributions must be made on after-tax basis. Web What category description should I choose for this box 14 entry. Web Read More Who Qualifies for the ERC Tax.

Web The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Benefits paid to. The contribution remains at just over.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income. Web tax treatment of family leave contributions and benefits under the New York program. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

After discussions with the Internal Revenue Service and its. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Yes NY PFL benefits are considered taxable non-wage income.

Paid Family Leave benefits are not subject to employee or. Web On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Web State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2.

Web Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. ACA Reporting Compliance Delaware ERC Florida I-9 New Jersey New York Paid Family Leave Payroll Tax. Web Paid Family Leave provides eligible employees job-protected paid time off to.

Web Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. Based upon this review and consultation we offer the following guidance. Web The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees.

Each year the Department of Financial Services sets the employee. Web Fully Funded by Employees. NYPFL or New York Paid Family Leave has caused some confusion regarding tax for New Yorkers.

After discussions with the Internal Revenue Service and its review of other. What category description should I choose for this box 14 entry. Web Understanding NYPFL Category On Your W-2 Tax Form.

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Altered State A Checklist For Change In New York State Empire Center For Public Policy

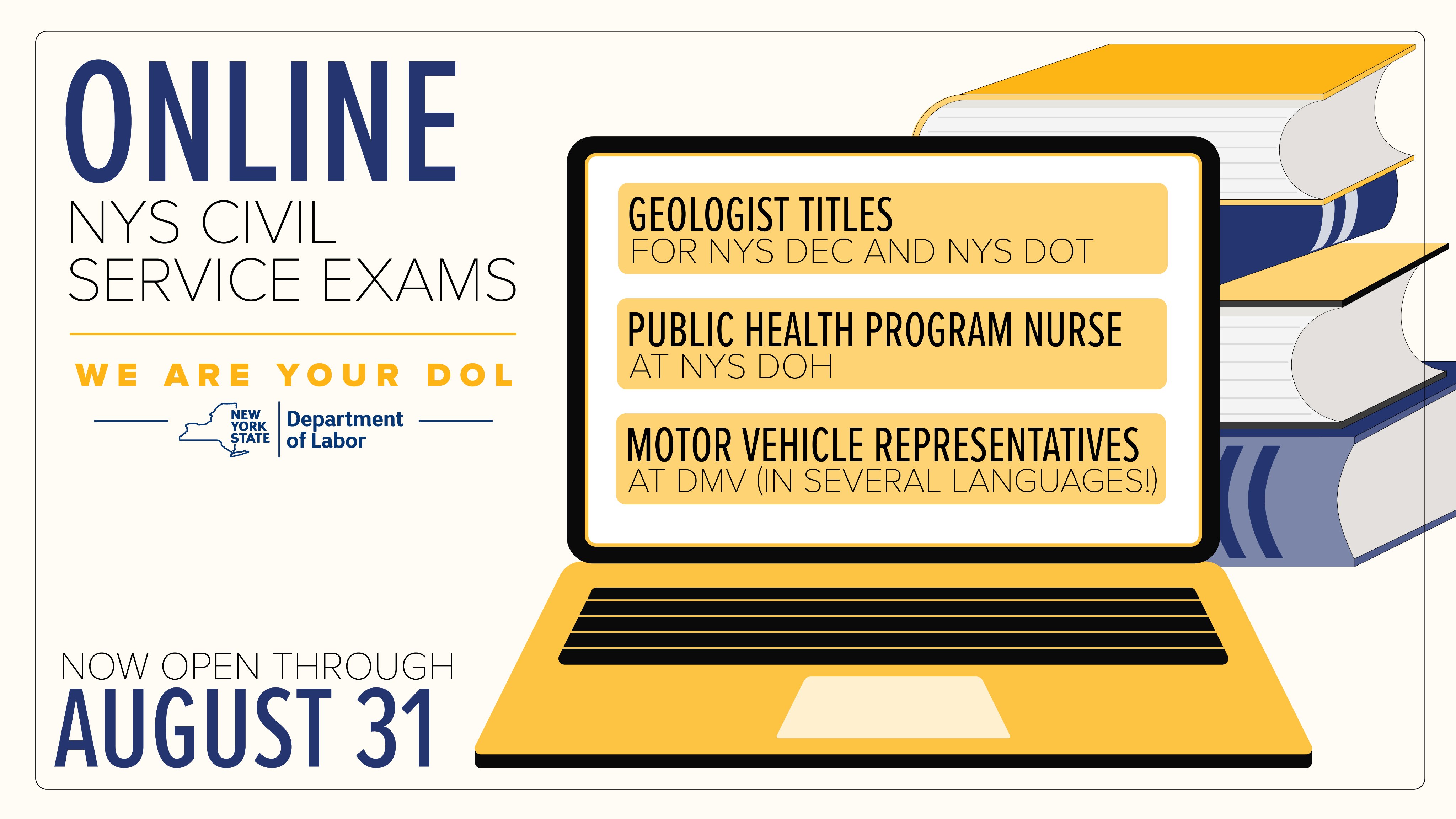

Nys Department Of Labor Nyslabor Twitter

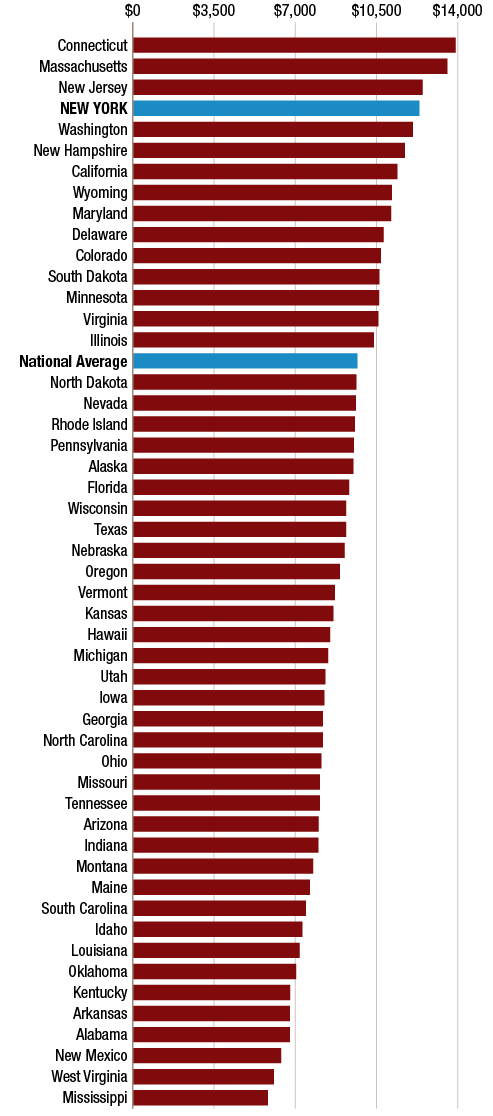

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New York State Paid Family Leave Law Guardian

Your Rights And Protections Paid Family Leave

Zomato Draws Praise For Introducing Period Leave For Employees The New York Times Paid Leave Workplace Independent Journalists

Time Off To Care State Actions On Paid Family Leave

Paid Family Leave For Family Care Paid Family Leave

A Complete Guide To New York Payroll Taxes

New York S Balance Of Payments In The Federal Budget Federal Fiscal Year 2020 Office Of The New York State Comptroller

Cost And Deductions Paid Family Leave

New York Paid Family Leave Updates For 2022 Paid Family Leave